CEO interview: Digi-Key builds for the future

SoeeNews Europeasked Digi-Key’s chief operating officer Dave Doherty (shown above left) and vice chairman Mark Larson (shown above right) to explain how the company is differentiating itself from other broad-line distribution companies and why it is significant for Europe.

Its 2016 sales put Digi-Key a long way behind market-leading distributors Avnet at $25.17 billion and Arrow Electronics at $23.8 billion, but it still puts Digi-Key somewhere around 6th to 8th in the world ranking of distributors, depending on whose list you look at. Back in 2012 DigiKey was ranked 9th, according to EDN.

Larson, who ran the company for many years, before handing over the reins to Doherty in 2015, said the aim is to be able to serve prototype- through to production-quantities of components faster than the competition. Out of about four million product lines in total, Digi-Key has 1.4 million products in stock and ready for shipment. “That’s twice as much product as anyone else, on two-day delivery – consistently,” Larson said.

这样做的关键是Digi-Key长期φlosophy of focusing on a single distribution warehouse at its Minnesota headquarters. Other distributors have regional warehousing and that complicates the supply chain within those companies, Larson and Doherty claim.

Digi-Key’s distribution model is aimed more towards fast turn delivery and support on prototyping for low to mid-volume applications, which nonetheless span application sectors from computing and telecommunications through medical, industrial and automotive. Digi-Key has built its business around fast delivery of parts and centralized multi-lingual support of customers available 24 hours a day and 7 days a week. “It also help us meet minimum order quantities. Aggregating demand can be used to hold MOQs for more customers,” said Larson.

Doherty stresses that Digi-Key does well when the customer’s design engineering team work well and efficiently get their own product to market and into volume. Doherty also emphasizes the culture in place at Digi-Key. “In Minnesota we are a big employer but we are still a relatively small company and yet we can compete on the world stage. We retain staff and they are supportive of customers; it’s in the culture.”

Digi-Key gross sales by product type. Source: Digi-Key

一个积极的文化更容易培养当排字工人any is growing profitably. And Digi-Key is growing in the global semiconductor market. As a private company it doesn’t discuss its profitability in any depth but it does reveal some sales details. In 2016 semiconductor components were 47.7 percent of Digi-Key revenue. Passive components were next most significant at 23.8 percent; electromechanical components amounted to 14.8 percent; and connectors and cabling were 13.7 percent. The global growth in 2017 is expected to be 25 percent taking Digi-Key annual sales up to about $2.3 billion.

Next: IoT suits Digi-Key

The company growth has been averaging 2.5 times market growth, Doherty said. Although that is not set to happen in a 2017 where the chip market is expected to grow by an unusually high 20 percent, partly down to strong average selling prices in memory. “You have to remember that 80 percent of the distribution market is the high-volume stuff,” he said.

Is that where Digi-Key has to go next to continue its climb up the distributor company rankings? “Digi-Key addresses the short- to medium-run – but never say never,” responded Doherty. Buit he also puts the arguments for staying in the sweet spot Digi-Key currently occupies. Doherty pointed out that micro-manufacturing is becoming more popular and in any case, high-volume distribution provides less opportunity to add value through support.

IoT suits Digi-Key

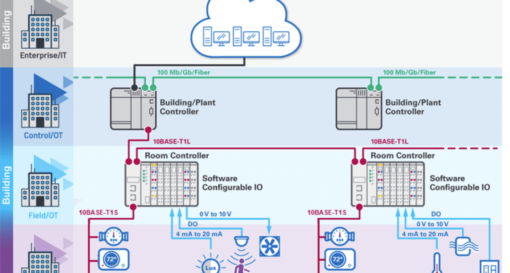

Doherty also pointed out that the rising tide of the Internet of Things was also something that played to Digi-Key’s strength. IoT is a highly fragmented market that has many relatively low volume applications being addressed by a large number of companies. IoT applications fall into all the sectors Digi-Key is already supporting.

“It is driving us to bring more sensors and actuators on to our books. And customers want us to vet out stuff that doesn’t work. That’s why we’ve brought on 100 suppliers with IoT lines across semiconductors, passives and connectors,” said Doherty. Reflecting industry trends Digi-Key is also offering more board-level and even system-level solutions, he said. “Development boards – such Beagle boards and Raspberry Pi – are also breaking into commercial embedded applications.”

Digi-Key European sales ($1 = €0.862 = £0.759). Source: Digi-Key

Digi-Key has about 90 engineers out of its total work force of over 3,500 employees, working on thousands of applications with customers. But it has too many product lines to support all of them. It cannot be like a specialist distributor with field application engineers for all its lines. In addition to engineering support and perhaps more importantly Digi-Key aspires to be the easy-access curator of engineering data for the industry. The company’s website does feature a broad collection of technical resources, multimedia content and a portfolio of design tools.

Next: Europe hot, Asia hotter

And Europe is undoubtedly a hot market for Digi-Key. Rather like IoT the fragmented nature of European market suits the prototype-to-production philosophy of Digi-Key. It was Larson, when he had been president of the company that had brought Digi-Key into Europe in 2003 starting in the UK. “The European market is so well-aligned with Digi-Key’s business model it would be almost be a sacrilege not to pursue it,” he said. Digi-Key has recently added a number of Eastern European countries and currencies to its activities.

And the European markets are some of Digi-Key’s strongest. Digi-Key expects to hit $60 million sales in UK in 2017, up 36 percent; Germany should generate $100 million of sales in 2017, up 39 percent; and Digi-Key’s French market is due to grow 33 percent to about $31 million. In 2017 Digi-Key added website support for an additional five European currencies; the Polish Zloty, the Swiss Franc, the Czech Koruna, the Hungarian Forint and the Romanian Leu. Overall Digi-Key’s European sales are expected to grow 38 percent in 2017 to reach $427 million.

However, it should also be observed that Digi-Key is expecting sales into the Asia-Pacific region to go from $243 million in 2016 to $396 million in 2017, an increase of a staggering 63 percent.

Room for growth: Source: Digi-Key

What can be expected from Digi-Key over the next few years is expansion while maintaining the centralized distribution model. And that involves expansion at Digi-Key’s headquarters campus with the construction of a 2.2 million square foot building, nearly four times the size of Digi-Key’s existing building on the site. There’s going to be a lot of automation and it is expected to be in use by the end of 2019.

As Larson and Doherty expect it will be in place in time there to serve increased distribution sales in IoT and other low- to mid-volume applications using the single-point distribution model sending components in increasing numbers to the Europe and Asia.

Related links and articles:

News articles:

Tronics MEMS gyro sensors in stock at Digi-Key

Neonode’s zForce AIR Touch sensors now at Digi-Key

Voice processing evaluation board for linear microphone arrays

Image sensor for very-low-light applications: medical imaging options expanded