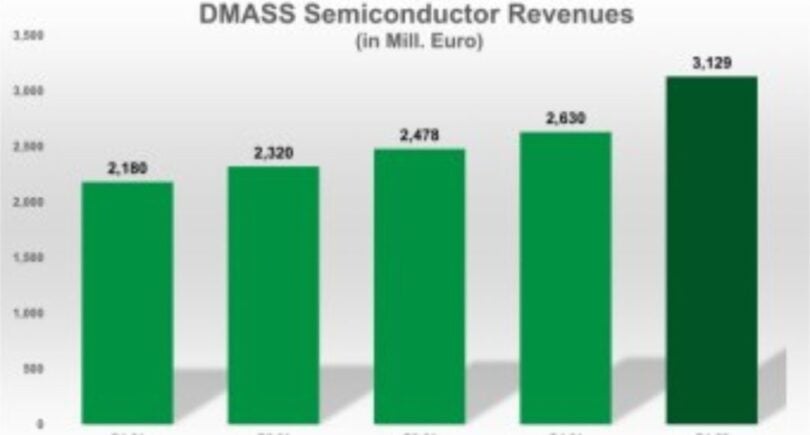

Record growth in European semiconductor market but warnings of slowdown

European distribution research firm DMASS reports Q1 growth of 43.5% in semiconductors and 35.7% in interconnect, passive and electromechanical components but warns of risks of the slowdown.

European components distribution reported significant growth of 40.8%in its first calendar year quarter to €4.75bn as the result of the chip shortage and higher prices.

Semiconductor sales reported by DMASS members grew by 43.5% to a new record €3.13bn. IP&E (Interconnect, Passive and Electromechanical) components grew by 35.7% to €1.62bn.

“A combined growth of 40% across all components is outstanding, but at the same time a clear sign of unprecedented times. The challenges of a post-CoVID recovery are now accompanied by the uncertainties of the Russian war against Ukraine and its ramifications for the entire planet. The human catastrophe of this war dwarfs every other concern, may it be unclear market expectations or supply chain disruptions. We hope that a just peace will be achieved soon,” said Hermann Reiter, chairman of DMASS.

- Semiconductor market heads for severe downturn says analyst

- Prepare for chip recession says analyst

- DMASS distributors see chip boost in Q2 of 2021

- Has the semiconductor market fundamentally changed?

DMASS reported a similar picture on semiconductor growth as in the last quarter:

- Germany grew by 45.4% to €867m

- Eastern Europe by 34.5% to €540m

- Italy by 45.6% to €310m

- Nordic countries by 46% to €240m

- UK by 47.8% to €213m

- France by 54.8% to €210m

In the product categories, Memories and Other Logic (ASSPs etc.) grew significantly over-proportionally and MOS Micro slightly faster than average, but most other product groups grew below average, although still in the 20 to 30% range:

- Analog grew by 42% to €886m,

- MOS Micro by 44.8% to €621m,

- Power by 36.5% to €375m,

- Memories by 71.8% to €328m,

- Opto by 26.1% to €260m

- Other Logic by 64.7% to €172m

- Programmable Logic by 33.5% to €165m

- Discretes up 41.9% to €188m

- Sensors and acutators by 34.9% to €88m

Interconnect, Passive and Electromechanical (IP&E) components again showed parallels to semis, but total sales grew in the 30% range.

“We can certainly be very satisfied with the financial results in the first quarter, although some of the growth is exchange rate as well as price-driven. However, we are definitely not happy with the continuing difficult supply situation, where we cannot serve customers in the way we want. While we all hope that the situation gets better towards the end of the summer, the current uncertainties make any prediction impossible,” said Reiter.

“The terrible war continues, economic growth expectations have been cut across the board, supply chains are disrupted by lockdowns in Asia, inflation is rising, energy supply is becoming unaffordable and customer confidence is sinking. We can only hope that this is all 2022 has in store for us,” he said.